Onnline Rule 3 GDS transfer cycle : June'2023

National Union of Gramin Dak Sevaks (FNPO) ,Andhra Pradesh Circle

Thursday, 1 June 2023

Tuesday, 2 May 2023

Wednesday, 30 November 2022

SOP for GDS online transfer

MOST IMMIDIATE

Sir/Madam,

Please refer to this office communication no. 17-31/2016-GDS dated 28.11.2022 on the above-mentioned subject.

2. In this context, the SOPs containing URL, credentials and instructions for data entry in the module are attached herewith. It is requested to circulate it to all concerned.

Yours sincerely,

Ravi Pahwa

ADG(GDS/PCC)

DAK BHAVAN,

NEW DELHI-110001

Monday, 28 November 2022

GDS Online Transfer

Processing oftransfer applications of GDS under limited transfer facility-introduction of GDS online transfer Portal.

National Unions PE,P4 & GDS Regional Level meeting at Visakhapatnam.

National Unions PE,P4 & GDS Regional Level meeting at Visakhapatnam.

NAPE Gr-C Visakhapatnam division President Sri Krishna Murthy garu addressing the meeting with P3, Postman & MTS, GDS divisional secretaries of Visakhapatnam Region on 27.11.2022 at KSN Residency about organization matters and mobilization for increasing membership. V Sivaji,GS, NAPE Gr-C, M Tirumalarao, CS, NAPE Gr-C AP Circle, David Raju Dy Circle Secretary AP Circle, CH Lakshmi Narayana, CS, Postman & MTS, AP circle, Yogeswararao, CS, NUGDS, AP Circle, Babji, President, Postman &MTS, Y V Ramana, President,NUGDS AP Circle attended and addressed the meeting.

L.Krishna Prasad,

Circle President, NAPE Gr-C, AP Circle

Tuesday, 22 November 2022

Wednesday, 18 November 2020

Meeting to be held at 3 PM on 19.11.2020 under the Chairmanship of Secretary (Posts) with the representatives of NFPE,FNPO and it's affiliated unions and AIGDSU through Video Conference.

Meeting to be held at 3 PM on 19.11.2020 under the Chairmanship of Secretary (Posts) with the representatives of NFPE,FNPO and it's affiliated unions and AIGDSU through Video Conference.

Provision of Rs.10 lakh to GDS and Departmental employees of Department of Posts to cover death due to Covid-19 while discharging official duties - Clarification regarding extension of guidelines dated 01.06.2018.

Provision of Rs.10 lakh to GDS and Departmental employees of Department of Posts to cover death due to Covid-19 while discharging official duties - Clarification regarding extension of guidelines dated 01.06.2018.

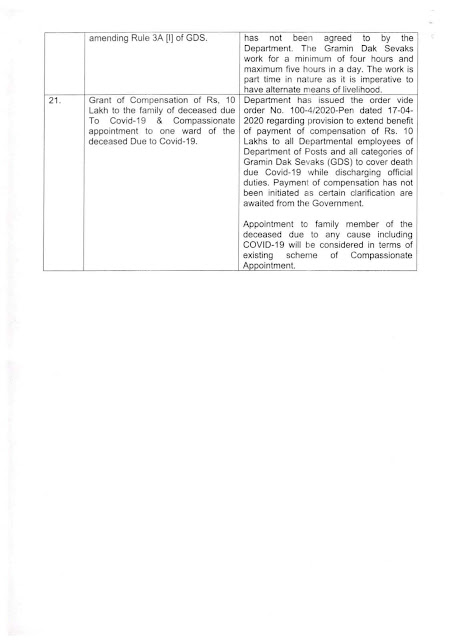

Reply received from Directorate on 21 Charter of Demands submitted by FNPO regarding 26th November 2020 General Strike.

Reply received from Directorate on 21 Charter of Demands submitted by FNPO regarding 26th November 2020 General Strike.

Monday, 16 November 2020

Standard Operation Procedure for handling loss / repair / replacement of assets provided to end user : IPPB.

Standard Operation Procedure for handling loss / repair / replacement of assets provided to end user : IPPB.